Crypto trading is a booming business and it pays to make use of every tool available. By using these tools, you can better understand your strategy for success as well as improve its output which will ultimately generate more profit in this competitive market! It’s hard to ignore the call of crypto trading signals. For those who are looking for something more than just ambient noise, this industry offers a lot that you could be needing right now.

Signals are the collected data about a currency’s price movement in tandem with the market. These can be received via email, SMS, or social media platforms and represent critical need-to-know data related to trading decisions in these currencies. Crypto signals give traders on the fly updates for their trades.

Signal Formats

Crypto trading can be a great way to make money, but only if you know what signals crypto traders give and how they work. There are two types: Automatic crypto Signals which will trade your currency for profit depending on the price of that particular day or contract as well as Manual Trading where users have complete control over their trades.

One of the most popular strategies for novice traders, automatic signal trading has gained momentum lately. Its advantage comes as it enforces unemotional behavior as well as increased execution speed on your trades – which is perfect if you don’t like getting anxious while trying to make money! One downside to working with automated software is that you have no control over the decision-making process.

There’s a reason why manual signal trading is so popular among experienced crypto traders. It gives them ultimate control of their investments and can be a great way to get out if something goes wrong with the algorithm or trader psychology, while still giving human intelligence some role in deciding when it should come into play.

Advantages and Disadvantages of Crypto Signals

Traders are always on the lookout for new information that will help them capitalize during trading. Crypto signals, or crypto trading setups shared by professional traders, do just this—although there is no guarantee and every trader has their own strategy when it comes down to how successful those signals can be in helping make money through these techniques

The fast-paced world of currency markets thrives off anticipation; what happens now may affect prices later today! That same intense focus means traders need all possible tools at hand so as not to miss out on any potential moves before anyone else does

Here are the few advantages

- Traders can take the help of cryptocurrency trading signals to improve their approach or strategies.

- Stay updated with what’s happening with the market through crypto signal updates that signals providers send.

- Cross check your strategies with crypto signals to observe what you’re lacking before taking a trade.

Disadvantages

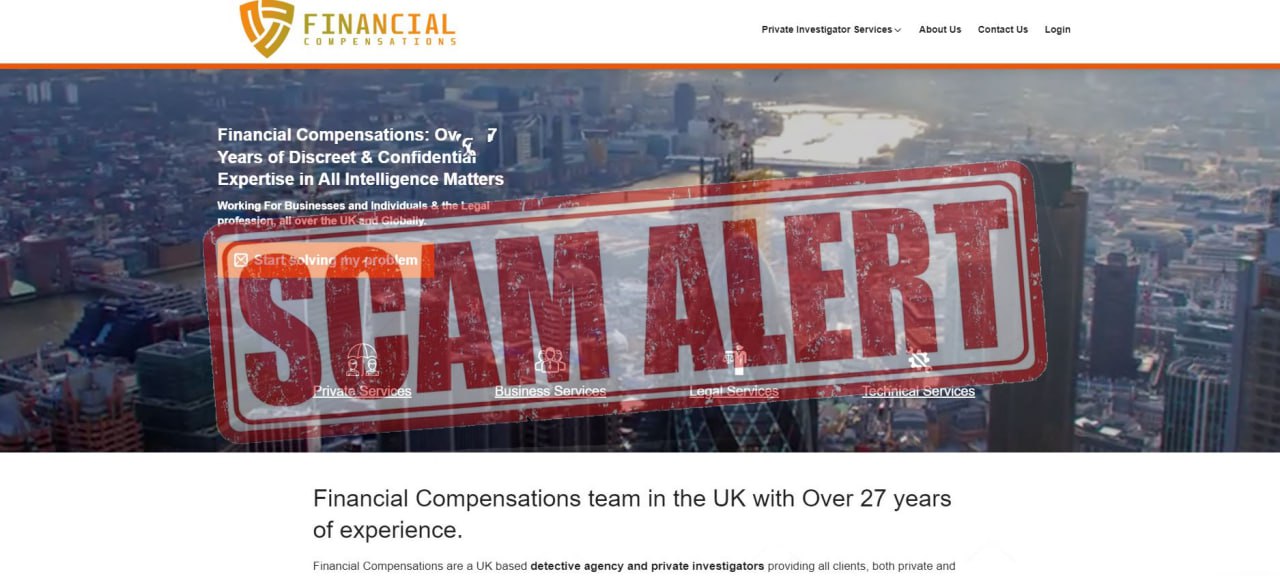

- Signals can be scam if not subscribed to a reliable service provider.

- Blindly relying on crypto signals can destroy your account.

- Wrong signals can be devastating.

- Poor risk management if not researched the signals.

Different types of crypto signal services

There are many competing signal services, but they’re not all alike.

1.. You’ve probably heard of free or unpaid signals, which usually come about through a voluntary service. This is because they’re typically given with no expectation of reward in return – just wanting to do what you can for someone else without any tangible gain on your end!

2..A service that provides paid or purchased signals acquired from using various methods including reading historical data, charting for price movement and market analysis.

3.. Paid or purchased signals from a provider who delivers through either algorithmic or personal analysis.

Conclusion

When you trade in crypto, one of the most important things to do is get a signal from someone who knows what they’re doing. And for this reason alone we recommend that all traders sign up with a well reputed crypto signal provider – who has good track record of being profitable.